Is this a review of 2023, or a forecast for 2024? It could be either, on the grounds it looks forward to look forward, taking its cues from the past 12 months in secret cellular – when the market showed good growth, but was still underwhelming ( and apparently under- confident ) in the context of its big talk and identity crisis. Anyway, the message from RCR Wireless, sitting on the fence, is that private 5G in 2024 will look much like personal 5G in 2023 inasmuch as it will matter to enterprises significantly and exceedingly – but not as much or as fast as the telecoms sector wants it to.

1 | Half a dozen dynamite business deployments– and no more

Over the next 12 months, there will be six or eight key multi-site and multiple- market private LTE/5G installations that will be legitimately held up at the end of the period as examples of a market that is starting to mature – or to signpost maturity, anyway. That will be it, no more – in the public domain, at least. However, people references will continue to be hard to come by, on the grounds that enterprises are intensely anxious and very economical by their nature.

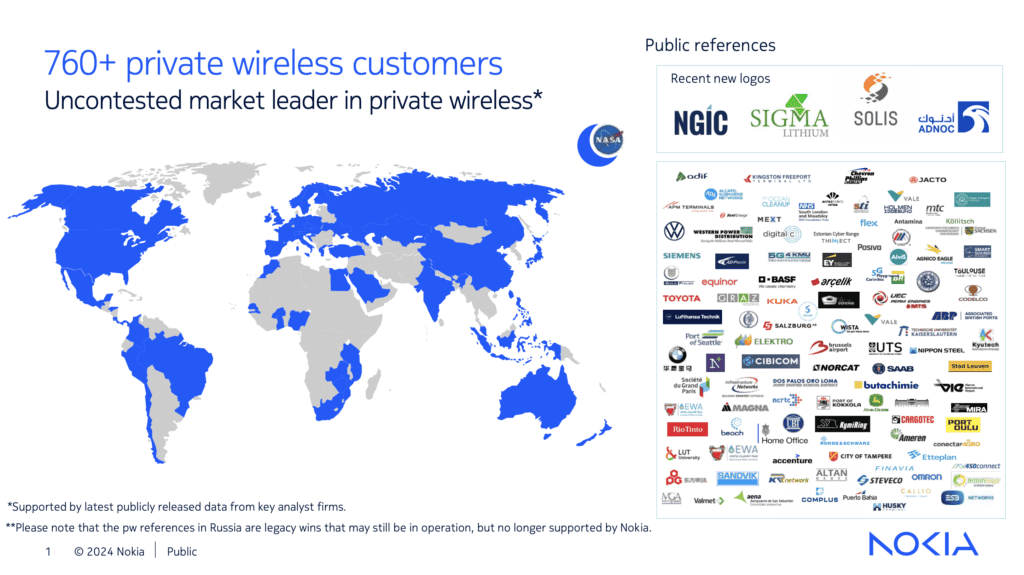

But these half- dozen huge deployments– with perhaps about half ‘prepared’ by large global SIs, a quarter by mobile operators, and another quarter by industrial specialists and others, in partnership often with Nokia, likely, leading from Ericsson in terms of RAN share, leading from the likes of Airspan and Cisco, in tandem with a hodge- podge of core network providers– will show how industrial cellular can be scaled by large enterprises across hundreds of sites.

Much like Dow Chemical, Airbus, and Schneider Electric, plus a very few others, showed in 2023, only on a significantly easier trajectory, where the investment is better understood, the technology is more common, and precedents already exist in most horizontal sectors. For the great beasts of business, in certain commercial disciplines, the point will come in 2024 where inertia costs them – as rivals start to tear – ahead with new digital- change infrastructure.

But by the end of the year, we will still only truly be able to look back at six or eight dynamite new private 5G projects in the Industry 4.0 game. Which will be much, all the same, to show the market is working.

2 | A handful of new use cases – for (slightly) easier business cases

Alongside the new growth in private LTE/5G deployment numbers– which, let’s say, will double to 6,000 by the end of the year, based on one analyst- house calculation of 2,900 (to date) at the end of 2023, and a wild journalistic wager that the market is spiralling kinda– upward – the whole ecosystem will bounce in 2024 because the number of applications to go on these networks will expand, again, not substantially, but enough to move the needle.

Where private cellular networks in 2023 – like in 2022 and 2021, when LTE was already sufficient to stand- up most services – tended to be bankrolled by fairly simplistic connectivity use cases, like on-site team comms and intra-site remote comms, plus a smattering of autonomous vehicles and robots ( AGVs and AMRs ), their business case will be strengthened in industrial venues in 2024 with the introduction of (a few) new Industry 4.0 applications.

Most significantly, perhaps, business drones—as remotely-operated flying inspection robots that can access the areas of construction sites, chemical plants, utility grids, and other challenging environments that field engineers simply cannot—appear to be set for a great year. Additionally, new 5G-type Industry 4.0 applications will be more difficult to identify through 2024 due to their propensity to depend on the lengthy millennial upgrade cycles of industrial equipment.

However, machine manufacturers are beginning to synchronize their portfolios with Release 17 of the 5G standard, and long-standing business IoT applications, such as those for predictive analytics and maintenance, are starting to be patched onto private biological systems from different private enterprise networks, so in 2024, the workload and justification for private LTE and 4G networks will steadily grow.

3 | A market that splits into two directions, both of which are departing from Industry 4.0 Inc.

All of this growth, which is probably unspectacular but assured and in line with the pace of enterprise transformation, will likely become most obvious as private 5G moves over and across the food chain, crossing all of these horizontal financial disciplines from multinationals with deep pockets to mid-sized corporations with less ostentatious intentions into fresh vertical markets.

Of course, this is where true maturity and scale occur. The way the “private” 5G proposition changes as the customer market grows and diversifies, as well as how its supply shifts to another system vendors, is an intriguing aspect of this. An increasing number of businesses are considering implementing variant systems, which connect to compute engines in a centralized cloud and occasionally even saa to run applications and frequently core network intelligence as well.

They will partially give up the localized edge-governed networklatency and security that have characterized early on-premises 5G deployments in more sensitive, and generally wealthier, industrial-grade disciplines. The discussion of public/private network roaming will also be put into practice in 2023 as businesses in the fiercely anticipated logistics industry, for instance, work to gain control over end-to-end tracking and monitoring solutions.

In non-critical and” carpeted” verticals teeming with smaller businesses, such as in white-collar business parks, open-necked urban areas, and much of the services-based economy that runs between, this is also where AWS and Microsoft will set up camp. The wireless operators will even pitch in with personal 5G financial offers, including tier-two players who have stayed out of the Industry 4.0 fray. The likes of Siemens will make an effort to support blue-collar SMEs.

4 | The saddest thing for telcos is a growth market with growth pains.

However, none of this—cellular’s growth and influence in the business world—will be able to quell the resentment among identity telcos, which were responsible for the invention of the technology. Yet in 2024, despite their successes, they will still be perceived as having failed, and they have. Because they created the market based on a variety of false assumptions, most notably the false belief that 5G, as publicized, is an advanced technology and that it is all-conquerable and under their control.

Additionally, they wrong believed that businesses would rush to purchase networks almost immediately in order to connect business devices in the same way that regular gamblers switch mobile phones. Of course, none of these things have actually happened, but they all cast a long shadow over their work in the business world. As a result, they will be in the same situation in 2024 as they compete with fierce supplier rivals, cautious business customers, and technology that falls short of expectations ( even though it excels at other things ).

What a missed opportunity private 5G is for telcos, which should be made in sad relief in 2024, is the saddest thing. Not because it was mis-sold, in fact, but rather because mobile operators have repeatedly failed to comprehend the principles of contemporary electronic engagement. Additionally, they have been unable to understand their offensive position in the provision of more comprehensive online services. As a result, in 2024, their failures will be accentuated.

Enterprises prefer a slow-sell with consulting and flexibility that solves their problems and is stackable enough to build progressive value because they do n’t prefer hard sells. New electronic change systems exist as an idealistic synthesis of cloud and IoT economics: they are built to be flexible, open, and scaled both ways on a zero-fat subscription. It is a theoretical endeavor, particularly at first.

This is the setting in which personal 5G operates and is reliant. However, connectivity is unique because it is a product with an obvious price and value. The telecoms industry despises the concept, but businesses effectively view 5G as a utility service that is just as essential to the economy as water and electricity. It is complete, even if it lacks the potentially transformative value of software or probably differentiated value like hardware.

As a platform to discuss the combined value of new IT/OT data acquisition, processing, and analytics systems, mobile operators should have now made more of this foot in the door and line on an invoice. Even though the market is busier than ever, it is still fresh and not too late.