In the latest update on its quarterly Private 4G/5G enterprise sales, Nokia has shown significant growth, adding around 30 new enterprise ‘logos’ in the second quarter of 2024, and 50 in the first half of the year. This performance outpaces Ericsson, which reported 20 new enterprise customers for the same period. Nokia’s strategic focus and early engagement in the private 4G/5G market have positioned it ahead of competitors, securing approximately 50% of the market share according to the GSA. The firm’s recent gains include notable deals in the public sector and smart cities space, with 18 new customers, and significant contracts in energy, utilities, and manufacturing. This growth reflects Nokia’s comprehensive edge package, encompassing edge computing hardware, specialist devices, and integration with Wi-Fi systems, which enhances its enterprise 4G/5G offerings. Despite the strong performance, the competitive landscape remains tight, with Ericsson poised to challenge Nokia’s dominance as the market matures. The ongoing developments underscore the dynamic and evolving nature of the private 4G/5G enterprise sector, highlighting the importance of strategic engagement and innovation in sustaining growth and market leadership.

Nokia Leads Private 4G/5G Enterprise Sales with 30 New Clients in Q2 2024

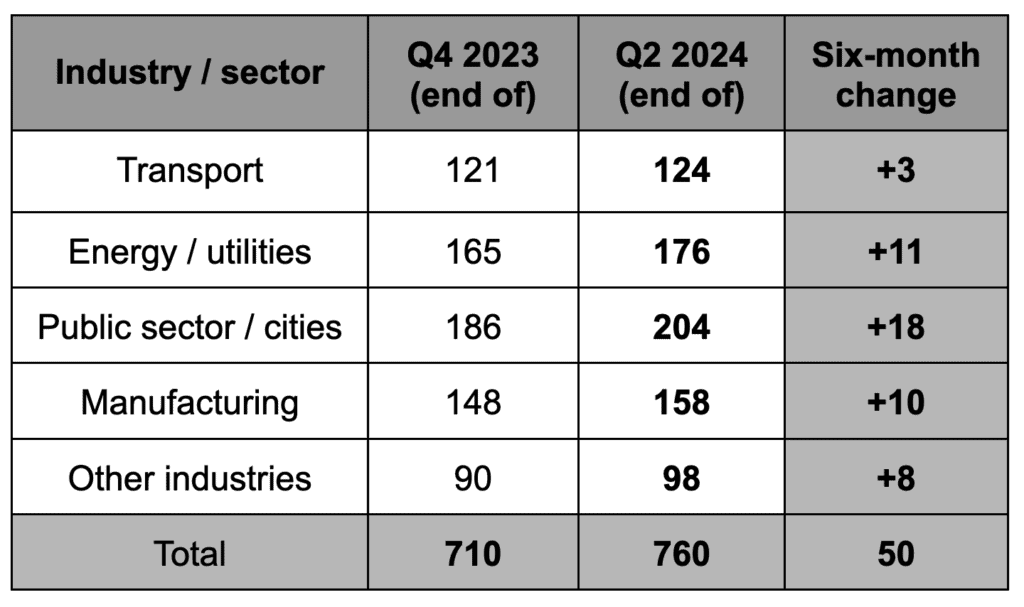

Finnish vendor Nokia has added some colour to its quarterly private 4G/5G enterprise sales, after not saying much at all in its official results announcement last week. The firm added around 30 new enterprise ‘logos’ in the three months to the end of June 30, it said, and 50-odd in the first six months of 2024. As a frame of reference (which is all it is), Ericsson claimed 20 new enterprise customers for private 4G/5G networks last week in the same second-quarter review – meaning, in one sense at least, Nokia outran its Swedish counterpart by about 50 percent in the period.

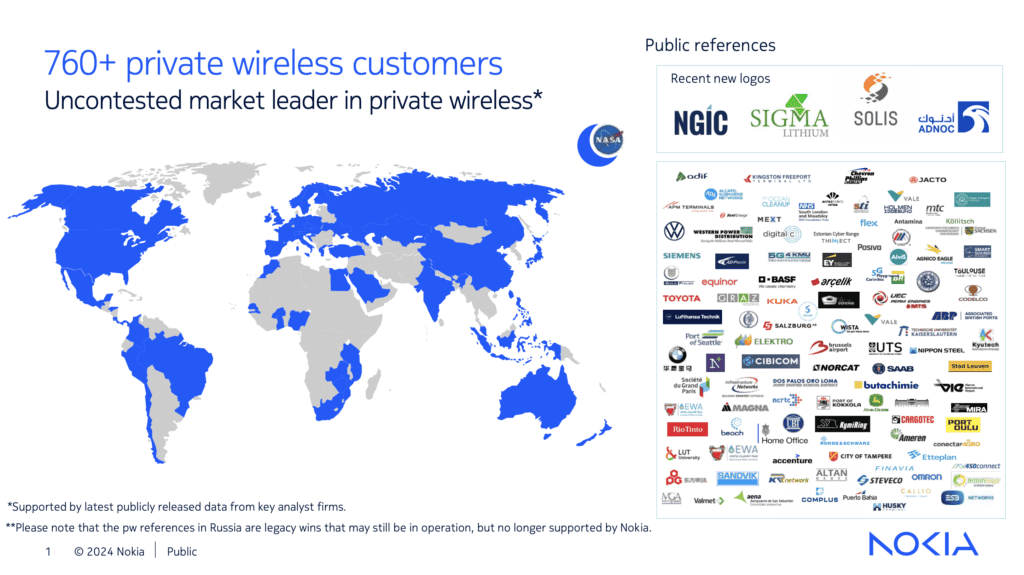

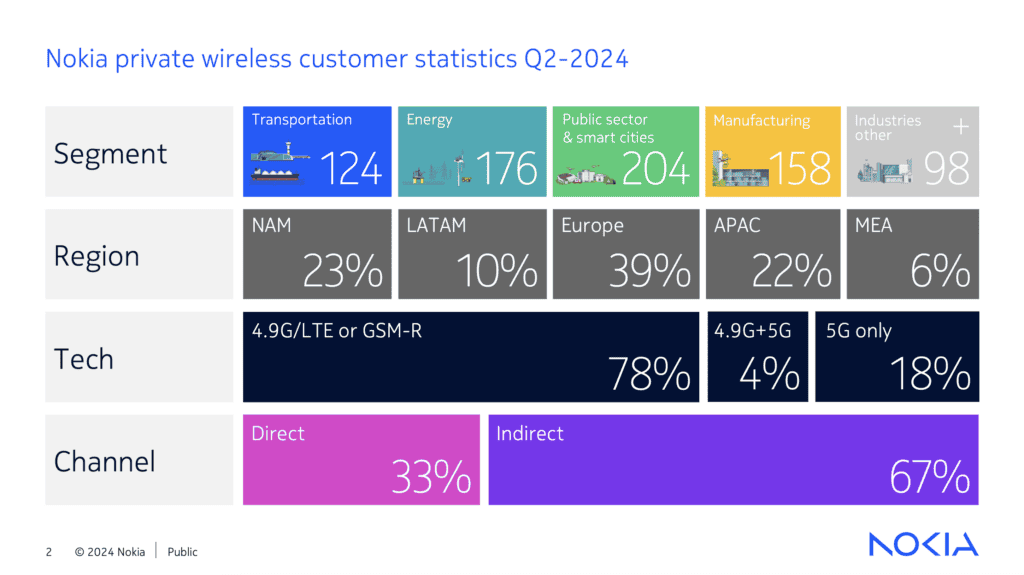

Nokia’s latest additions leave it with around 760 customers, as it stands. Ericsson is trailing in terms of its total customer count and also its run-rate, it seems. But Nokia has been at it for longer than most vendors in the space, including Ericsson – in terms of its strategic intent, product development, enterprise engagement, and channel activity. Nokia claims a 50-odd percent share of GSA’s recorded private 4G/5G installations, as contributed by (certain) members of the vendor community. Ericsson is playing catch-up; but Ericsson is also shaping up, perhaps.

Nokia’s Steady Enterprise Sales Growth Despite a Quiet Quarter

There are a few other things to note about the numbers, too – and also to say about this useful, but somewhat forced, Scandi-faceoff. It is understood (but not clear) that both outfits are counting the same way – commercial deployments by customer, by country. This is the metric the GSA uses to chart progress in the market. It means only proper engagements are counted. Proofs and trials are not; neither is repeat business, which covers multi-site expansions with existing customers – whether multiplying client deployments at single sites or to other sites in the same country.

As such, this logo-count – really a per-country customer count – is not a sure sign of success. Nokia could easily have had a better first quarter in revenue terms when it posted 20 new logos than it did in the second quarter when it recorded 30 – just by selling more networks to fewer customers. Ericsson may even have sold more in the second; such details have not been shared. But this seems unlikely, given their form. The indication from Nokia is that where it matters – on the top line, anyway – its first quarter was very good and its second quarter was pretty good.

Which bucks the trend, perhaps, if the talk about a seasonal ramp-up through the calendar year is correct, but also possibly follows it exactly if logo-counts rise through the third and fourth quarters. In terms of ‘logos’, anything above 40 would count as a bumper period, it seems. In review, Nokia told RCR Wireless that it was “not a very eventful quarter”, in the end, which largely “aligned” with the same period last year. “Growth remains strong and steady,” it said, also referring to “more multi-site deals” and “signs of increased penetration into smaller sites”.

It shared a couple of slides, including one with an asterisked subheader about its “uncontested leader(ship)” in the market (say “key analyst firms”, it noted), and a quartet of major new public wins in the period. Some of these have been covered in these pages (see here for its deal with mining firm Sigma Lithium in Brazil, and here for its deal with oil company ADNOC in the UAE). But a couple haven’t: contracts with Solis Tower Telecom do Brasil to connect the agricultural industry in Brazil, and with various partners to build a shared nationwide 5G network in Ghana.

Nokia Sees Strong Growth in Public Sector and Smart Cities for Private 4G/5G Networks

In the end, the whole shakedown clearly requires more data and closer analysis. But what Nokia’s appended quarterlies do show is that it is adding most new-customers in the vast public sector and smart cities space (18 in the quarter), which ranges from quick-fire deployments with schools and universities, where deals are small and quick, to bureaucratic entanglements with national and local government operations, where they are slow, but also big. It also covers the defence, public safety, and healthcare sectors, where they are somewhere in-between.

Besides, Nokia signed 11 new logos in the period in the energy and utilities market, and 10 in the (process and discrete) manufacturing sector; by contrast, new-client sales to the transport and logistics industry, covering mainline and urban railways, plus also airports and shipping ports (and possibly warehousing), look like they fell off a cliff in the quarter (plus three) – although Nokia would likely say the ports industry was a forerunner in the private networks game, and that a handful of operators control the world’s ports, and that it is upselling and cross-selling all the while.

Logic says the same, actually. The other quote from Nokia, in response to questions about its quarterly private 4G/5G sales, is that it did well in the quarter for “more and more bundled sales”. This is, arguably, the biggest plus for the Finnish firm, which has, over the last eight quarters or more, constructed a rather comprehensive looking edge package around its essential (and multi-tiered) edge 4G/5G offer for enterprises. This includes a portfolio of edge computing hardware, specialist devices, industrial applications, and smart interplay with house Wi-Fi systems.

Nokia Leverages Edge Computing Hardware to Boost Private 4G/5G Sales in Public Sector and Smart Cities

This is Nokia’s advantage, it reasons – and an explanation, also, of why periodic logo-additions will count for less and less in the market. That, and because creeping maturity in the market will see integrators and resellers increasingly farm existing business, while the long Industry 4.0 harvest for new clients continues on a slow cycle. It is where – as suggested, on reviewing Ericsson’s quarterlies, and as logic also says – that Ericsson will be required to raise its game. The irony is that, of all its rivals, Ericsson – without much effort, and with rivals faltering (Metaswitch) or integrating (HPE/Athonet), or hardly registering (Samsung, even Huawei outside of China) – remains Nokia’s closest competitor.