As the global market for precision agriculture solutions surges, propelled by a compound annual growth rate (CAGR) of 11.4 percent, according to Berg Insight, the landscape of modern farming undergoes a transformative shift. Precision farming practices, leveraging telematics and Variable Rate Technology (VRT), aim to optimize yield, enhance productivity, and curtail agricultural inputs. Despite widespread adoption of auto-guidance and onboard display-controlled machine monitoring, interoperability hurdles persist, impeding seamless data sharing.

Key players in the precision agriculture arena encompass major agrarian equipment manufacturers like Deere & Company, Trimble, and Topcon Positioning Systems. Input giants such as BASF, Bayer, and Syngenta pivot into the market via strategic acquisitions, focusing on mapping tools and decision-support systems for input optimization.

In tandem, a cadre of emerging leaders in in-field sensor systems, including Sencrop and Davis Instruments, spearheads innovation. As the industry shifts towards autonomy, manufacturers venture into automatic devices like robotic tractors and drones equipped with multispectral cameras and LiDAR sensors. With satellite navigation, artificial intelligence, and machine learning driving automation, the future of farming heralds a new era of efficiency and precision.

Advancing Precision Agriculture: Telematics, VRT, and Interoperability in the IoT Era

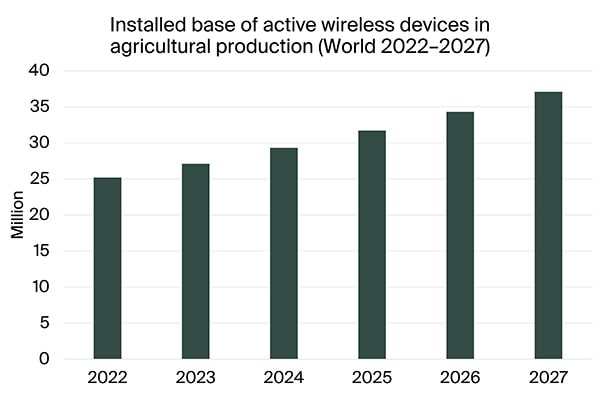

The global market for precision agriculture solutions is expected to expand from € 3.1 billion in 2022 at a compound annual growth rate (CAGR) of 11. 4 percent to reach about € 5.2 billion by 2027, according to new research from the IoT analyst firm Berg Insight.

Precision farming practices use a variety of technologies to manage field variations in order to maximize yield, increase productivity, and reduce the use of agricultural inputs. Telematics and Variable Rate Technology (VRT) are still in the early stages of adoption, despite the fact that solutions like auto-guidance and machine monitoring and control via on-board displays are currently widely used in agriculture. Interoperability between solutions is still a problem, despite advancements in programs that offer frequent protocols and language structures for data sharing.

The majority of main producers of agrarian equipment currently engage in operations involving precision agriculture using a variety of techniques. The largest manufacturer of agrarian equipment in the world, Deere &, Company, is one of the top suppliers of precision agriculture solutions, followed by Trimble, Topcon Positioning Systems, Raven Industries, and Hexagon. Major input producers like BASF, Bayer, Corteva Agriscience, and Syngenta have largely entered the market through acquisitions and are concentrating on offering mapping tools and decision-support for input optimization and yield maximization. On the burgeoning market for in-field sensor systems, a group of businesses have emerged as market leaders. These include Sencrop, Davis Instruments, Pessl and its METOS brand of instruments, and Semios.

From Automation to Autonomy: The Next Frontier in Agricultural Innovation

The second stage in the development of the agricultural industry is the transition from automation to autonomy. Veronika Barta, an IoT analyst at Berg Insight, stated that while autonomy on a component level has been abused by numerous manufacturers, intelligent agricultural operations on an equipment level are now on the rise.

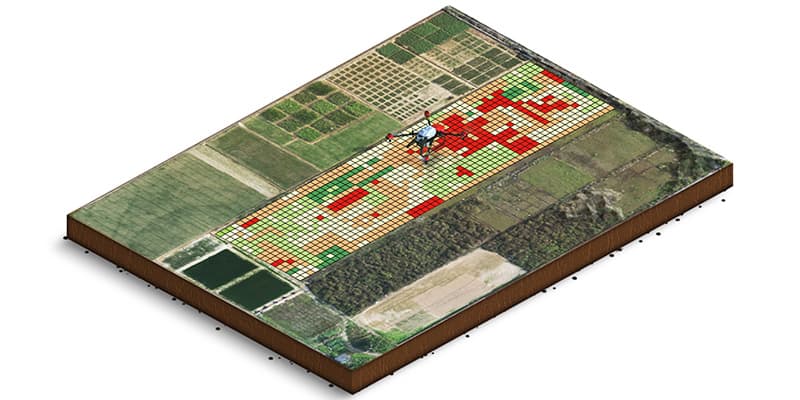

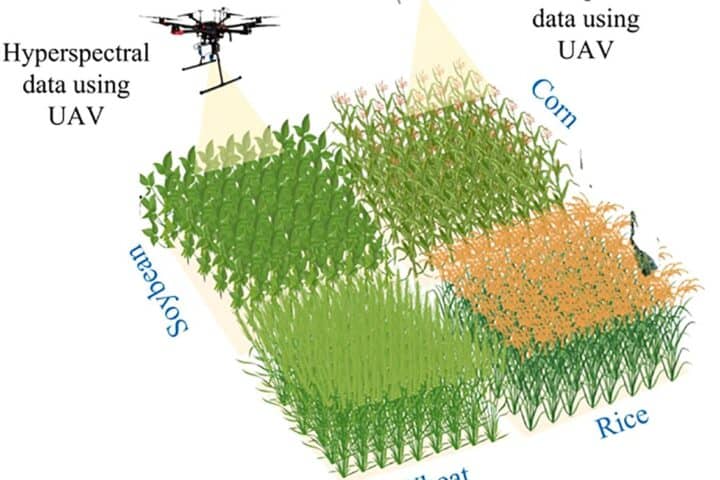

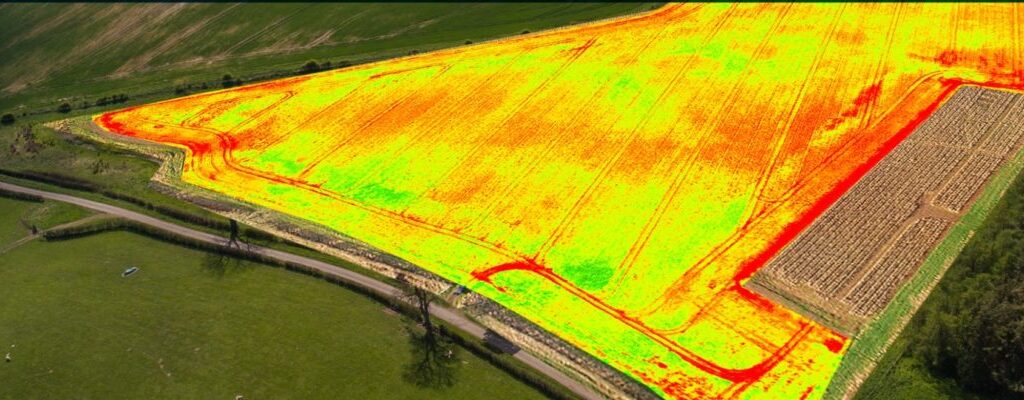

Manufacturers of original equipment are currently creating automatic devices like robotic tractors and robots for planting seeds. The most sophisticated segment of agricultural drones uses multispectral cameras, LiDAR sensors, and route algorithms to perform automatic operations. The most popular application area for crop monitoring is underwater imagery, followed by spraying operations with crop protection chemicals. In the future of farming, automatic equipment will primarily be enabled by satellite navigation, sensors, unnatural intelligence, and machine learning.

Navigating the Precision Agriculture Landscape: Overcoming Interoperability Challenges Toward Autonomous Farming

As the precision agriculture market continues to surge, propelled by technological advancements and a growing demand for efficiency, key players are leveraging innovations such as telematics, Variable Rate Technology (VRT), and in-field sensor systems. However, interoperability challenges persist despite widespread adoption. Major equipment manufacturers and input giants are strategically positioning themselves through acquisitions and offerings in mapping tools and decision-support systems. The industry is transitioning towards autonomy with the development of robotic tractors and drones equipped with advanced sensors and AI capabilities. The future of farming promises unprecedented levels of efficiency and precision through automation and technological integration.