More than 88 million bright electricity meters are expected to be installed throughout Europe between 2024 and 2028, indicating that the market is poised for steady growth. The leading IoT analyst firm Berg Insight, which has closely followed the growth of this market since the company’s founding in 2004, concluded this, among other things, in its most recent detailed study of the German bright metering market.

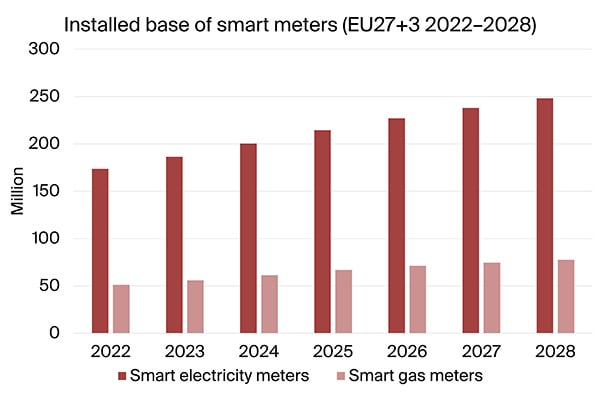

At the end of 2023, more than 60 % of EU27+3 electricity consumers had access to a bright meter.

More than 186 million bright electricity meters were located in the EU27+3 region at the end of 2023. The installed base of smart electricity meters is anticipated to reach a penetration rate of 78 percent by 2028, driven by second-generation rollouts in nations like the UK, Italy, Spain, and Sweden, as well as first, generation projects in Germany, Poland and Greece. This growth is steady and north of 6.1 %. The installed base of devices in the EU27+3 region, where it is anticipated that the market for clever gas metering will grow from 56 million units in 2023 to about 78 million by 2028, is also expected to experience strong growth.

Two significant changes are expected to affect the composition of bright electricity shipment volumes, signaling a shift away from Western European markets, which have historically been at the forefront of deployments for smart metering.

First-generation electricity meter shipment volumes will make up 67 percent of all shipping volumes over the course of the forecast period, as subsequent generation rollouts in Western Europe are either finished or in their last stages. Second, according to Mattias Carlsson, an IoT analyst at Berg Insight, the share of first-generation shipment volumes to nations in the CEE and SEE regions will rise from 50 % in 2022 to 80 % in 2030.

The type of communications technologies being used for data exchange with the utility’s back office has also changed in the bright metering market over the past few years. Over the course of the forecast period, between 55 and 65 percent of annual shipment volumes will be made up of standalone wireless connectivity options, which have become increasingly popular in recent years.