EIT InnoEnergy and Demeter Investment Managers have jointly announced the launch of the “EBA Strategic Battery Materials Fund” in a proper partnership aimed at strengthening Europe’s battery industry.

The EBA Materials Fund is committed to fostering the growth of a strong and various battery raw material supply chain in Europe. It is supported by an investment of €500 million.

The CEO of EIT InnoEnergy, Diego Pavia, emphasized the importance of the action for the battery ecosystem in Europe, saying that “to ensure a vibrant and tenacious European battery industry, we must intensify our efforts in domestic battery raw material production.”

“While it’s encouraging to see a growing number of ambitious initiatives and financial incentives from public and private players, their focus is typically on mature projects ( post-Final Investment Decision).”

However, these initiatives require a steady stream of de-risked projects, so we also need to concentrate on early-stage inland projects (scoping, PFS, and DFS), which are dedicated to producing battery materials in an environmentally friendly, identifiable manner. This is precisely what the EBA Materials Fund will provide.

Bridging industry gaps in the face of rising demand

As the demand for batteries in Europe soars to previously unheard-of heights, the EBA Materials Fund appears at a critical juncture, highlighting significant shortcomings in the downstream parts of the EU’s battery material supply chain, such as mining and processing.

The fund specifically targets improving domestic capacities for critical battery materials like lithium, nickel, cobalt, manganese, and graphite in accordance with the Critical Raw Materials Act ( CRMA ) of the European Union, which aims to lessen reliance on foreign supply.

Dynamics of a proper alliance

The fund manager will be Demeter Investment Managers, a well-known Western private equity and venture capital firm that makes use of its wealth of infrastructure and greentech expertise.

Since 2017, the European Battery Alliance ( EBA250 ) and EIT InnoEnergy, a driving force behind sustainable energy innovation, have contributed their sector-specific heritage and extensive early-stage investment expertise to identify and support high-risk projects.

The sole financial advisor for the capital raising, Societe Generale, will outline the fund’s proper and all-encompassing approach to financial operations.

The EBA Materials Fund’s goals

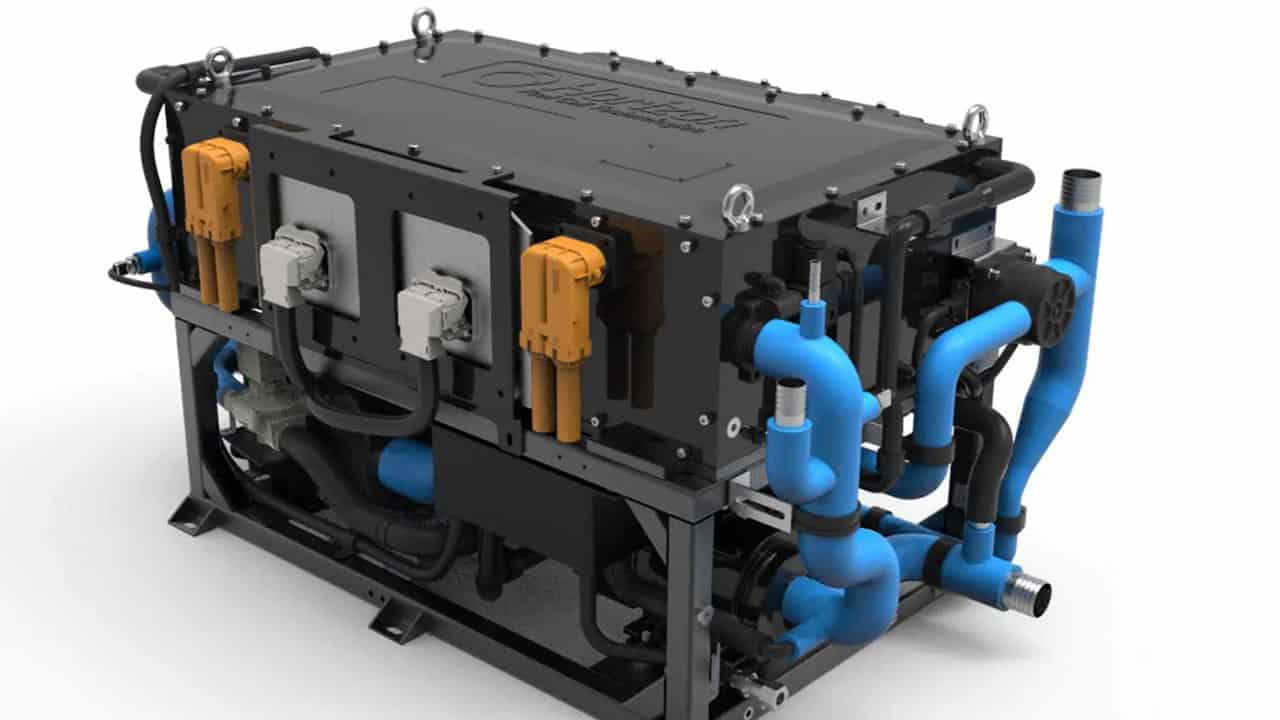

The EBA Materials Fund’s dedication to allocating at least 70 % of investments to initiatives boosting EU domestic production is a key component.

This includes activities in the EU and its neighbors that range from mining and processing to refining and recycling.

The remaining 30 % will be used to increase the supply of raw materials from nations that are members of the EU Raw Material Partnership, such as Canada, Namibia, and Argentina.

Concentrate on the sustainability of battery materials

The EBA Materials Fund will support initiatives that adhere to the strictest economic standards, emphasizing economic responsibility. This includes adhering to the traceability, sustainability, and circularity sustainability standards set forth by the EU Battery Regulation.

Additionally, the fund seeks to be categorized as an Article 8 fund under the EU’s Sustainable Finance Disclosure Regulation (SFDR) in order to achieve one of the highest ESG classifications.

The battery industry is of proper importance and a crucial battleground for international competitiveness, Commission Executive Vice President Maroefovi added.

Hence, it is essential to keep improving our game, with obtaining battery raw materials being the one most difficult task ahead.

“Today’s ground-breaking announcement demonstrates that we are serious about expanding our domestic European capabilities and fostering diversification through trade and collaboration with trustworthy partners.” We must be strong, agile, and tactical.

A crucial initiative in preserving Europe’s dominance in the world battery industry is the EBA Strategic Battery Materials Fund. The fund is prepared to have a significant impact on determining the future of the Western battery landscape by addressing supply chain vulnerabilities and emphasizing sustainability