In November, there was a noticeable increase in new car registrations in the European Union, specifically for electric vehicles, demonstrating the region’s growing preference for green mobility options.

EVs accounted for more than half of new car registrations in 2023, according to recent data from the European Automobile Manufacturers Association (ACEA). This increase heralds a convincing development in the automotive industry in favor of electric vehicles as an affordable substitute.

EU New Car Registrations: Battery-Electric Vehicles Surge Amidst Varied Trends

New car registrations for battery-electric vehicles increased by 16.4% in November, bringing the impressive total to 144,378 units.

The growth was varied, and it was greatly aided by a number of markets. Importantly, Belgium emerged as a standout performer, securing its position as the fifth-largest market for battery-electric cars by volume with an impressive 150.2% increase.

Germany, on the other hand, suffered a setback as battery-electric car sales fell by 22.5%, which was an anomaly in an otherwise upward trend.

Despite Germany’s economic downturn, the overall numbers for the year show promise, reflecting a startling 48.2% increase in battery-electric car sales over the previous year.

The year-to-date volume has increased to almost 1.4 million units as a result of this surge, which also accounts for 14.2% of the EU car market during this time.

The three largest markets for these vehicles, Germany (+38.4%), France (+35.8%), and Italy (+30.2%), saw an increase in new hybrid-electric car registrations by 28.7% in November.

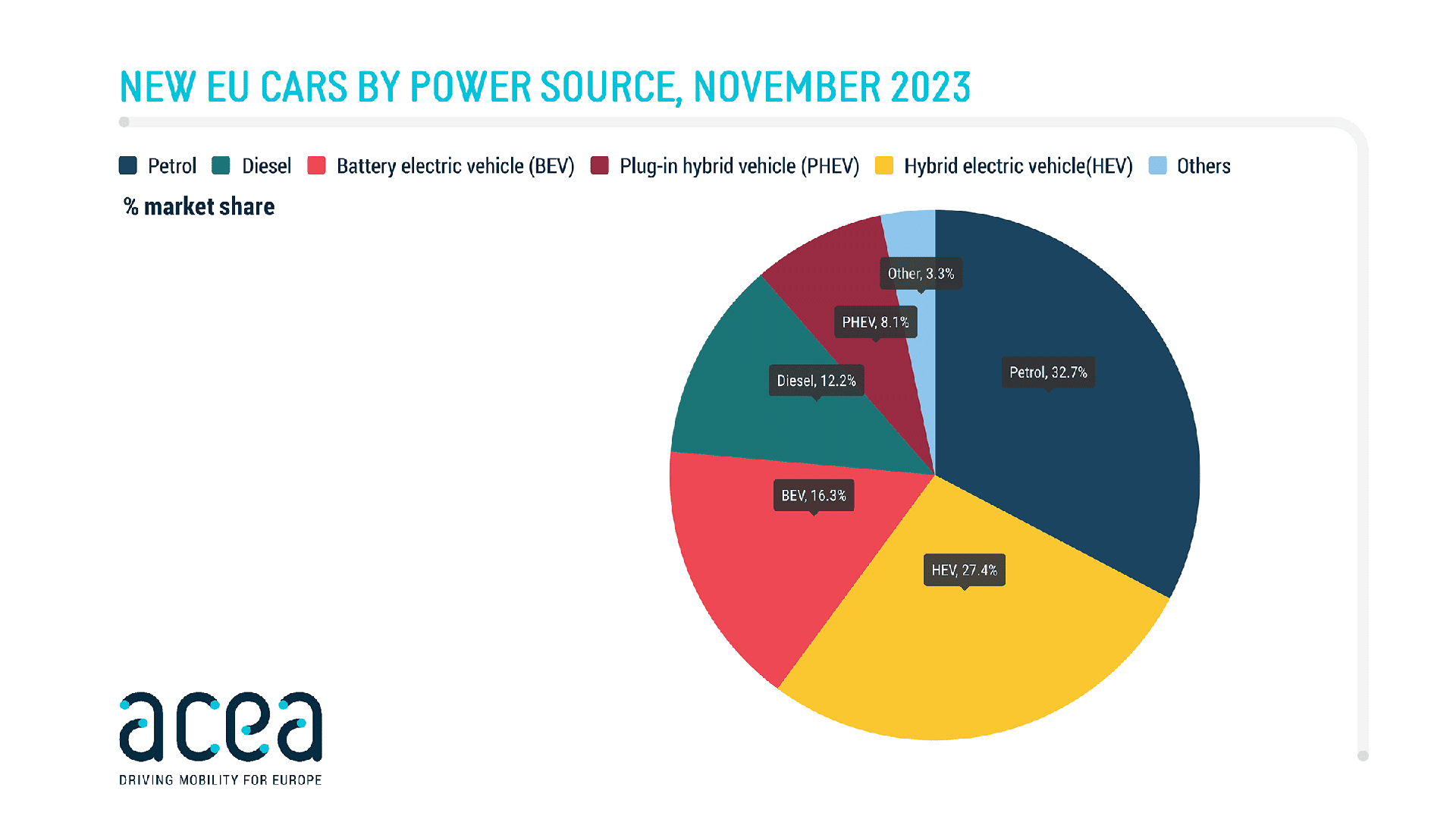

The total number of hybrid energy vehicles sold as of November exceeded 2.5 million, or more than a quarter of the EU market share.

But, plug-in hybrid electric cars suffered a setback in November despite the general increase in electric vehicles.

Sales fell by 22.1% to 72,002 units, and Germany, the country with the largest market for this power source, saw a significant decline (-59.3%).

The decline in Germany, which caused a drop in market share from 11.1% last year to 8.1% in November this year, was unaffected by the notable increases in Belgium (43.8 %) and France (17.8 %).

These statistics show a variety of trends across various types of electric cars, highlighting the complex landscape of adoption for electrical vehicles in the EU.

While battery-electric vehicles are still dominating most markets, plug-in hybrids faced difficulties that were generally brought on by the decline in the German market.

However, the general trend in the sales of electric vehicles suggests a positive direction for the region’s mechanical industry.

![Average Price For An Electric Car For 2023 [EV Prices], 49% OFF](https://autovista24.autovistagroup.com/wp-content/uploads/sites/5/2022/05/GettyImages-1224753106-e1653926376475.jpg)

EU Automotive Market Dynamics: Petrol Surges, Diesel Declines Amidst EV Advancements

Despite advancements in EV adoption, the sales of gasoline and diesel vehicles in the EU’s electrical sector changed noticeably in November 2023, indicating amazing changes in market dynamics.

Despite holding at 32.7% the month before, the petrol car segment of new car registrations unexpectedly increased by 4.2% amid a persistent decline in market share.

Significant sales spikes in important markets like Italy, which rose by 20.2%, and Germany, where they increased by a remarkable 12.5%, fueled this growth.

A commanding 35.7% market share over the course of eleven months was claimed by the cumulative sales volume, which reached a sizeable 3.5 million units, representing an impressive 11.1% increase.

The EU’s diesel car market, on the other hand, continued to decline, falling by 10.3% in November.

The majority of the bloc’s markets experienced this decline, which had a significant impact on the four biggest markets: France (-28.3 %), Spain (-22.8 %), Italy (-7.4 %), and Germany (-11 %).

Despite this general decline, diesel car sales increased in some Central and Eastern European markets, such as Poland, showing a 13.8% increase. Diesel car market share decreased to 12.2% in November from 14.5% in the same month the year before.