In the switch to clear transportation and energy systems, batteries are crucial. Without them, not only would the electrification of vehicles be difficult, but their provision of grid-scale energy storage also serves as the foundation for a future powered by solar energy.

Graphite has a great energy density and is an excellent conductor of electricity because it is condensed carbon. It weighs up to 50 % of the weight of a lithium-ion battery, making it ideal for batteries. Therefore, a key component of international efforts to combat climate change is the security of supply for this component.

It supports scientific advancement and fuels the world economy, just like many of the various substances listed in the EU’s Critical Raw Materials Act and the U.S. Department of Energy.

Size of the difficulty

The rapid adoption of electric vehicles ( EVs ), whose sales have increased by 35 % year over year since 2016, is a major factor in the supply of graphite supply chains, which are already exhibiting signs of major strain. By 2030, there will be a 777 000 tonnes annual global deficit, according to new projections. This shortfall poses a serious obstacle to nations’ efforts to achieve their climate goals.

Additionally, synthetic graphite is strongly preferred among the different types currently available on the market due to its superior performance to natural ( mined ) graphitate.

Countries would need to more than triple their current chemical production capacity in order to meet demand with only synthetic graphite, leaving them completely reliant on high-emission processes that rely on feedstocks made from fossil fuels.

On the other hand, it would take nearly 100 novel mines to meet demand for collected graphite. Importantly, each of these would have enormously adverse social and economic effects and cost citizens hundreds of millions of dollars. Poorer quality batteries would also be produced in response to demand for this type of graphite, jeopardizing the public’s confidence in the dependability of fresh technologies.

To solve this enormous world challenge, a village will be required.

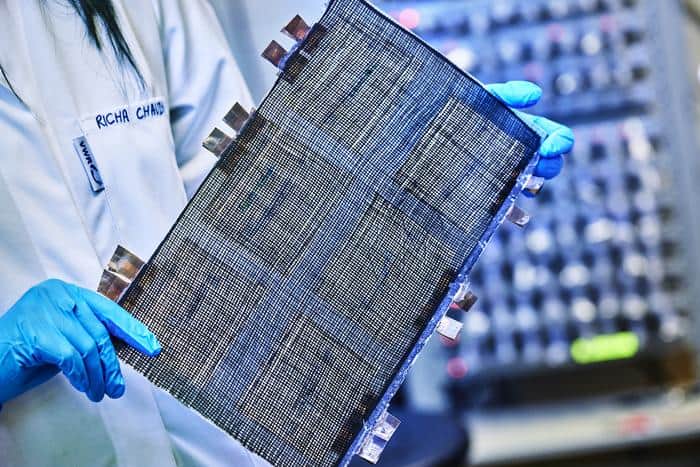

Biographite as a remedy

To offer the kinds of solutions that can integrate with current technologies and provide us with a real-world solution, other innovations will be required.

Biographite is one for remedy. Biographite, which is made from by-products of forestry, such as wood chips, is a brand-new type of manufactured graphit. We are confident that by using less than 5 % of the monthly by-products produced by the forestry sector in Europe and North America, we will be able to produce enough of it by 2030 to meet half the anticipated worldwide demand for both EV and grid-scale batteries.

In comparison to its conventional artificial and natural counterparts, its production can even be scaled much more quickly. A biographite plant, in contrast, can be permitted in less than 12 months, whereas it can take 12 to 18 years to commission a fresh mine in the EU and the US. When these plants are functional, biographite can be produced in a matter of hours as opposed to the current weeks and months needed to make anode-grade graphitate.

Supply chains for graphite must be diversified.

China already dominates tungsten supply chains, producing 98 % of the last, processed material that is used to make battery anodes, in addition to the present demand shortfall. Any disruption to that country’s production or exports would be a serious threat to their climate goals.

Worryingly, the Taiwanese government has already demonstrated a propensity to use force to assert its dominance. For instance, it put limitations on the export of germanium and gallium, two components that are frequently used in semiconductors, in July 2023. Importantly, China announced plans to limit exports of( higher-grade ) graphite starting in December just last week.

The need to diversify the supply chain for this essential material cannot be overstated. As technology and electrification develop, but will the significance of graphite. Production in the area will be crucial in making this happen. In the face of China’s dominance, the development of solutions like biographite, which come from regional, green feedstocks, will ensure safe supply chains while also shortening them.

The International Summit’s Results

These global issues highlight the significance of the IEA’s recent decision to establish a new Energy Security and Critical Minerals Division and to host the first-ever global summit on essential minerals and their contribution to the transition to clean energy at the end of September this year.

Six important initiatives for protected, green, and responsible supply chains were presented at this summit:

- Boost development toward a variety of material supplies,

- Unlock the potential of recycling and technology,

- Encourage transparency in the markets,

- Increase the accessibility of trustworthy information,

- Make incentives for ethical and responsible behavior, and

- Encourage cross-border cooperation.

A way forth

Some of these initiatives can be advanced by countries using ecological substitutes for essential materials, especially by accelerating the diversification of graphite supply chains.

Action two initially seems to be especially difficult for graphite because it can’t usually be recycled. But, when viewed more widely, existing replacements support this claim by recycling regional byproducts that would have otherwise been left to decompose, thereby reducing waste and the more greenhouse gas emissions.

These alternatives can make use of technology’s potential to increase resource efficiency. For every tonne of biographite it produces, it removes the equivalent of 2.7 tonnes of carbon emissions, which is a carbon-negative alternative to the essential material.

In contrast, conventional synthetic graphite production results in an astounding 35 tonnes of carbon emissions per ton, and the extraction and production procedures needed to produce a single tonne of anode-grade graphITe from mined graphitate can leave an enormous 15-ton carbon footprint.

This solution speaks to the next action as well: onshoring production encourages greater transparency for end users in an otherwise opaque market by enabling the localization of supply chains.